Susan Dunne who is a 54 year old widow has come to you for advice. She owns 50% of the issued: Corporation Tax and Capital Gain Assignment, TU Dublin, Ireland

| University | Technological University Dublin (TU Dublin) |

| Subject | Corporation Tax and Capital Gain Assignment |

Assignment Brief

Susan Dunne who is a 54 year old widow has come to you for advice. She owns 50% of the issued shares in MM Ltd, a manufacturing company she established with her late husband Mick, in 1979. Mick died a number of years ago. Susan bought the shares for €5,000 in March 1979.

Included in the company’s assets is a house, bought 5 years ago for €300,000 and now worth about €150,000. The house is adjacent to the business premises and was bought because Susan thought they might incorporate the offices into the house. They secured planning permission but never proceeded with the plan, and the house has been let since at a rent of €700 per month. Also included in the company’s assets is a portfolio of quoted investments bought in 1994 for €75,000. These are currently valued at €200,000.

Susan has worked full-time in the company since its opening and has always been a director. When her husband died in 2012, he left his 50% of the shares in the Company to their only son Richard who has worked in the company and been a director of the company since then.

Are You Searching Answer of this Question? Request Ireland Writers to Write a plagiarism Free Copy for You.

Susan feels the time has come to leave the business. She wants more leisure time, but she also acknowledges that there are increasing strains between her and Richard about the direction the company is taking. She feels that her continued presence will not alone inhibit him in developing the business but may damage her personal relationship with him. That said, she does not feel there is any urgency about her retirement.

She has been approached by a local investor who has offered to buy some or all her shares, at market value. She is reluctant to do this as she would like the company to remain in the family. Richard has no material funds, but feels he may be able to borrow up to €35,000 in a personal capacity.

Susan has her own house, which she has lived in since May 1982. It has been valued at €350,000, and the valuer also indicated that it could produce an annual rental income, (net of expenses), of about €14,000. She has considered selling her house as she would rather like the idea of living in the house adjacent to the Company. She also has an apartment which she bought in November 2000 for €160,000, and is unsure how much it is worth today, but a lady in the golf club told her it was worth €200,000.

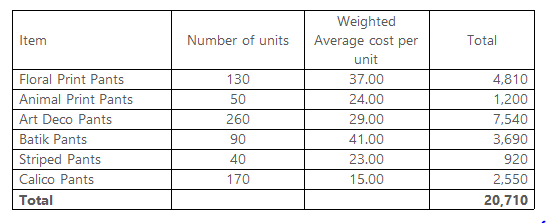

The shares in MM Ltd are valued by reference to the net asset value of the company. The market value of the assets and liabilities of MM are:

You are required to write a professional report for Susan providing appropriate advice for her individual circumstances, as presented above. The report should address the following points:

- Advise Susan of the Capital Gains implications if she disposed of her shares now.

- Advise Susan whether she should dispose of her shares now or at a later date that might be more beneficial to her from a tax point of view and whether it would be better to dispose of them to her son Richard or the local investor. Give reasons for your advice.

- Explain to Susan whether she would have a Capital Gains tax liability if she decides to sell

- Her own house

- The apartment

Stuck in Completing this Assignment and feeling stressed ? Take our Private Writing Services

"In need of academic support? Look no further! Our best assignment writing service in Ireland is here to help. With our dedicated homework helper team, Ireland students can now easily pay our experts for guidance on their courses. Dive into the complexities of Corporation Tax and Capital Gain Assignments offered by TU Dublin and other institutions across Ireland.