Luca Group. is considering investing in one of two possible projects (A & B) that will involve the development of a new production line: Corporate Finance Assignment, ICD, Ireland

| University | Independent Colleges Dublin (ICD) |

| Subject | Corporate Finance |

Question 1

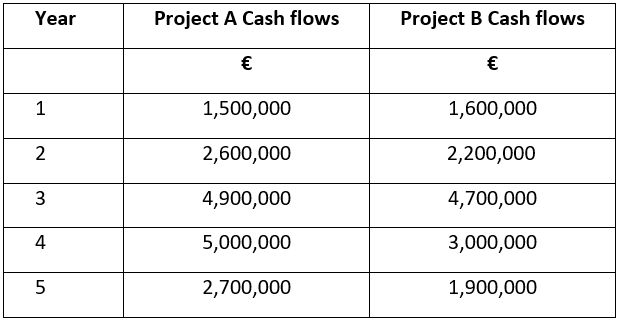

Luca Group. is considering investing in one of two possible projects (A & B) that will involve the development of a new production line.

The initial investment will be €11,500,000.

The company has a cost of capital of 10%. The Cash flows are as follows:

- Calculate for each project:

- The Payback period

- Net Present Value (NPV)

- Following the calculation of the above investment techniques identify which project should be undertaken by Luca Group. and outline the reasoning behind your choice

- Explain one advantage and one disadvantage of the Payback period method and the IRR method of investment appraisal.

Question 2

- Briefly describe four different stakeholders in a Corporate Organisation, and explain how their objectives may vary

- Provide an explanation of Debt Factoring as a source of finance for the firm

- Explain how the Acid test liquidity ratio can be used by managers to control the business

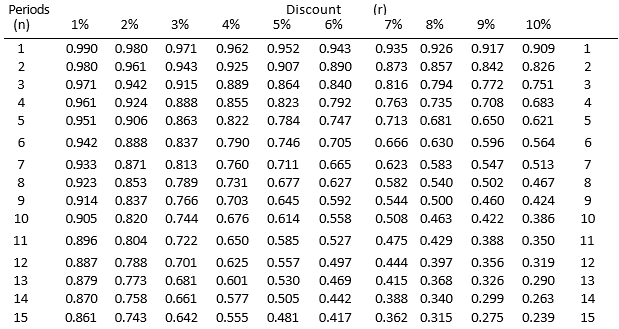

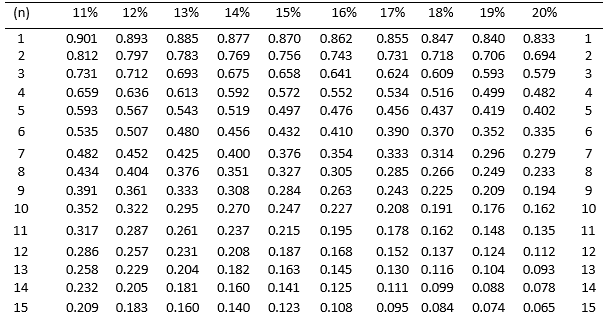

Present Value Table

Present value of 1 i.e. (l + r)– n

where r = discount rate

n = number of periods until payment

If you're looking to buy assignments online in Ireland, look no further than Irelandassignments.ie. Our team of experienced assignment writers are experts in a wide range of subjects and will work closely with you to ensure that your assignment meets all of your requirements. Visit Irelandassignments.ie today and see the difference for yourself!