It is on 30 September 2022. You are a tax consultant working in a large accountancy firm, Smith, Murphy & Co, located in Birr: Taxation Case Study, MU, Ireland

| University | Maynooth University (MU) |

| Subject | Taxation |

It is on 30 September 2022. You are a tax consultant working in a large accountancy firm, Smith, Murphy & Co, located in Birr, Co Offaly. You recently met with long-standing clients of the firm, Deirdre Collins (65 years old — born on 1 June 1957) and her daughters, Louise and Susan who are each Irish tax resident, ordinarily resident and domiciled.

Deirdre’s husband (and father to Louise and Susan), Sun, died on 8 April 2022. Under the terms of Sean’s will, he bequeathed the farm to Louise. Full ownership of the farmhouse (adjacent to the farmland) passes to Deirdre under Sean’s will. Sean fanned the land all his life but he inherited it from his own mother in June 2018.

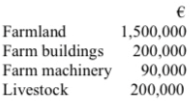

A professional valuation of the farm assets on the valuation date, which was 5 September 2022, was as follows:

Louise is a vet and runs her own veterinary practice after graduating from UCD with a degree in Veterinary Science. Over the years, she helped out her father in running the farm whenever she could find the time but has largely devoted herself to running the veterinary practice which is going from strength to strength and was valued at €500,000 on 5 September 2022.

Louise also owns 50% of the marital home she shares with her husband and three children which is currently valued at €300,000 (and has an outstanding mortgage of E110,000). She is very happy that her dad left the farm to her and so intends to hire a farm manager to run it on a daily basis on her behalf.

Susan is also happy that the farm has been left to Louise as she feels that her parents provided her with a good education and everything she needed growing up so she doesn’t think she has been unfairly treated. In any event, her mother Deirdre plans to transfer 100% of the shares in her company Nadur Foods Ltd to Susan sometime in the future.

Nadir Foods Ltd is a very successful company operating in the catering sector. Deirdre has been a full-time working director of the company since it was incorporated in July 1988 and she is the 100% beneficial owner of the shares which comprise 100 ordinary shares of €2 each. Deirdre subscribed for her shares at par value in July 1986.

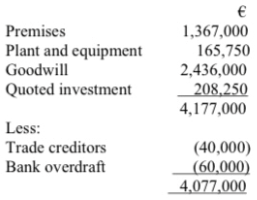

Deirdre’s shares in? gird& Foods Ltd has recently been professionally valued at €4,077,000 based on the following asset and liability values:

Susan graduated from college with a degree in Food Marketing and has worked with Deirdre in Nod& Foods Ltd on a full-time basis since August 2020. Deirdre is torn as to when to actually retire from the company and pass on the reigns to Susan. Part of her would like to retire in December 2022 and part of her would like to hold off retiring until 2024 when Susan will have gained some more experience in the business whilst she is still involved.

Deirdre previously sold shares in 2020 which triggered a taxable gain off 1,000,000 on which she only paid 10% Capital Gains Tax due to revised entrepreneur relief so she is keen to explore if she is able to avail of any other relief on a gift of her Nidtir Limited shares to Susan.

Louise and Susan each took an inheritance of €35,000 from their grandmother in 2017. Other than that, they have not received gifts or inheritances from any other sources.

Turning to some routine tax issues, in 2022 Deirdre tells you that she bought and sold shares in ATT Bank plc to an unconnected third party as the share price was the best it’s been in years. She carried out the following share transactions in ATT Bank plc over the years:

- 1/06/1988 – 1,500 shares purchased for €2,500;

- 01/12/1990 – bonus share issue of I for 1;

- 01/11/1994 – bonus share issue of 1 for 2;

- 01/06/1998 – rights issue offer of 1 for 6 at E3.10 per share;

- 05/05/2004 – sold 1,000 shares for €5.60 per share;

- 01/04/2022 – bought 875 shares for €7.10 per share;

- 16/04/2022 – sold 875 shares for E6.80 per share; and

- 30/08/2022 – sold 2,000 shares for €10.10 per share.

Deirdre recently sold a painting to her sister for its open market value and made a loss of €15,000 on the sale. She hopes that she can offset this loss against any gain(s) arising from the sale of her ATT Bank plc shares this year.

Earlier in 2022, Deirdre also bought a second-hand commercial property for €750,000 as an investment opportunity. The deed of conveyance was executed on 1 March 2022. The contract for sale was signed on 15 January 2022 but no consideration was paid until the sale closed on I March 2022. However, the Stamp Duty return and Stamp Duty liability are still outstanding hence Deirdre is keen to get everything sorted before 30 November 2022 and asks for your assistance.

Are You Searching Answer of this Question? Request Ireland Writers to Write a plagiarism Free Copy for You.

Struggling to write your next report? Let Irelandassignments.ie take care of it for you! Our team of professional assignment writers are passionate about delivering top-notch report writing services, ensuring that your journey towards a successful report is an easy one. Enjoy the expertise and experience from our knowledgeable experts—we promise excellence in every step!