9B16M070: Netflix International Expansion Case Study – Strategic Business Analysis

| University | Trinity College Dublin |

| Subject | 9B16M070: Netflix International Expansion Case Study |

NETFLIX: INTERNATIONAL EXPANSION

Won-Yong Oh and Duane Myer wrote this case solely to provide material for class discussion. The authors do not intend to illustrate

either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying

information to protect confidentiality.

This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the

permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights

organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western

University, London, Ontario, Canada, N6G 0N1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com.

Copyright © 2016, Richard Ivey School of Business Foundation

Version: 2016-04-26

In October 2015, Netflix released its report on its third-quarter earnings. Although growth in the United

States was weak, with profits dropping 50 per cent compared with the year before, the number of

international subscribers was nonetheless increasing at a rapid pace. However, not all international

subscribers were satisfied with Netflix’s service.2 Global expansion was strategically important for the

company to offset the financial impact of its slow growth in the domestic market. Reed Hastings, the chief

executive officer (CEO) of Netflix, stated that accelerating the company’s international expansion would

put it on the right track and would offer resources for reinvestment in its service, as well as developing and

licensing more content.3 However, U.S. operations still represented about two-thirds of Netflix’s revenues,

and the company faced challenges ahead in its push to expand internationally.

COMPANY OVERVIEW

Netflix was a publicly traded company that offered subscription video streaming and online digital video

disc (DVD) and Blu-ray Disc rental services, all for a flat fee of US$7.99 a month.4 By January 2016, the

company had an estimated 74 million subscribers worldwide, ranging from its domestic market of the

United States to markets as geographically diverse as South Korea and Poland. As of 2015, Netflix

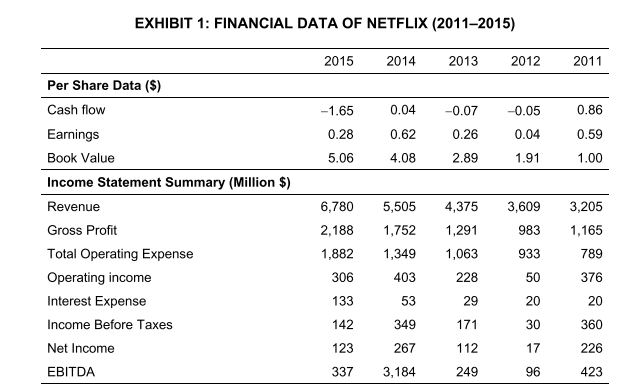

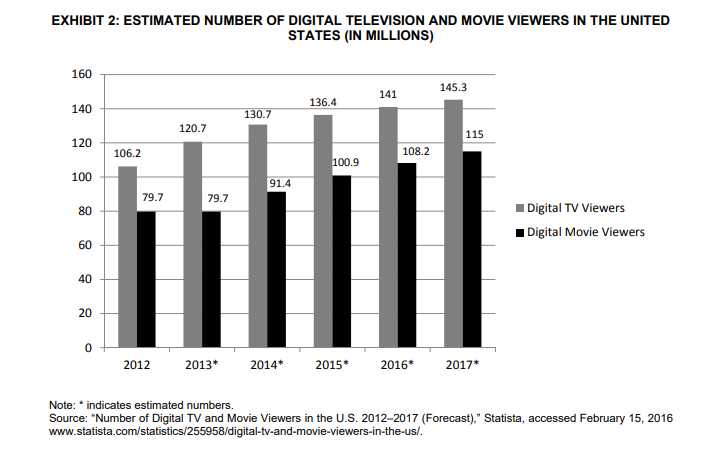

employed more than 3,500 full-time employees and reported revenues upwards of $6.78 billion (see Exhibit

1). Its plans for 2016 included further expansions targeting a worldwide market (barring selected countries

with stringent regulatory restrictions).

The company’s status as a dominant power in the Internet streaming services industry found its roots in

relatively humble beginnings. Netflix was conceived as the solution to the common, but annoying, problem

of overdue fees on video rentals. Founded in 1997 in California by current CEO Hastings and entrepreneur

Marc Randolph, the idea for Netflix came about after Hastings faced a $40 late fee on a video he rented and

forgot to return for six weeks.

The Rise of Netflix and the Demise of Blockbuster

At the time of Netflix’s conception and launch, the video-rental industry was dominated by Blockbuster, a

video-rental company that relied on multiple locations in suburban centres and the willingness of customers

to patronize its locations. Randolph and Hastings launched the Netflix website on April 14, 1998, as a pay-

per-rental DVD-mailing service, charging $0.50 per rental. They introduced the concept of a subscription-

based service in 1999, moving away from the idea of stand-alone rental stores that Blockbuster had

popularized.

Netflix experienced substantial growth at the turn of the new millennium. In 2002, it launched an initial

public offering (IPO) to sell shares of its common stock, selling 5.5 million shares at $15 per share. The

popularity of Netflix’s business model quickly resulted in the obsolescence of the model that Blockbuster

had so successfully utilized. Ironically, the video-rental store chain was offered the opportunity to purchase

Netflix in 2000 for $50 million, but Blockbuster declined the offer.

On September 23, 2010, amidst the rising demand for streaming services and declining demand for DVD

rentals and sales, Blockbuster, facing declining market share and $900 million in debt, filed for bankruptcy

protection.

Move to Internet Streaming and VOD

In 2007, Netflix began to reengineer its core business model away from mail-order DVD rentals to Internet

streaming and video-on-demand (VOD), accurately predicting that the volume of DVD sales and rentals

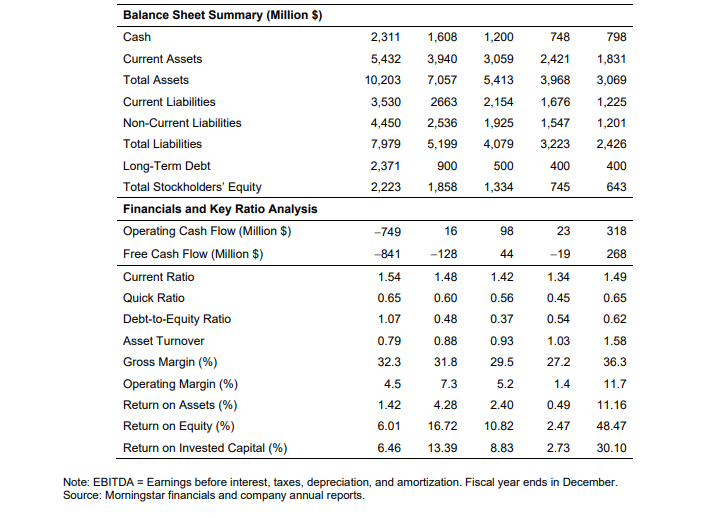

would eventually fall.10 By 2010, its streaming service had experienced substantial growth and expansion in

the U.S. market (see Exhibit 2), a change that soon became reflected in a shift of corporate strategy in 2011.

In the same year, Netflix announced its intentions to separate and rebrand its DVD-rental service as the

stand-alone subsidiary company Qwikster, effectively dividing its two core services and focusing its

existing brand and activities on its streaming service. The intended strategy was never implemented, largely

due to subscriber backlash that resulted in the company’s first-ever decline in subscribers.

Since 2011, the company had experienced steady periods of growth in both subscriber numbers and total

revenue. In 2014, the company hit a subscriber milestone when it surpassed 50 million worldwide

subscribers, 36 million of whom were in the United States.12 Netflix had supplemented its role as a content

provider by providing original content, acting as a developer of popular TV programs such as Orange Is the

New Black and House of Cards. Netflix concluded the 2015 fiscal year with a market value of $32.9 billion,

making it more financially valuable than established television networks such as CBS.

Business Model

Netflix’s business model was dependent upon the full integration of the Internet — its successful

incorporation and utilization of the Internet were critical in competing against, and eventually overtaking,

Blockbuster in the home entertainment industry.

Netflix generated revenue primarily through its subscription system, through which subscribers paid a flat monthly fee to have access to its digital library of movies, television shows, and other original content.

Although Netflix moved away from its roots as a primarily DVD-by-mail service, the company continued to generate significant cash flow from its business in the DVD-by-mail sector.14 Its DVD-by-mail business, which operated only in the United States, generated $80 million in contribution profit in the last quarter of 2015, with about 4.9 million members.

However, the company did not generate any revenue from providing advertising services. In June 2015, Hastings restated his decision on this topic: “No advertising coming onto Netflix. Period.

INDUSTRY OVERVIEW

The Internet television and video-streaming industry revolutionized the way people accessed entertainment. The VOD business model contributed to the demise of video-rental stores like Blockbuster by offering a wide selection of new releases in a content delivery system that was faster and more convenient for the

consumer.

The industry benefited from the improvement of streaming technology and in the further development of mobile devices, from which viewers could access streamed content. With the widespread adoption of mobile viewing platforms like tablets, large-screen smartphones, and laptops, VOD capitalized on the business opportunities available by streaming through the Internet. The Internet was an indispensable tool

in launching the content-streaming service, but companies in the industry found themselves competing with video file sharing websites like the Pirate Bay and Megaupload, which offered viewers the same, if lower- quality, content for free by avoiding expensive licensing agreements with content providers.

Competition

The industry was traditionally dominated by a small number of firms, but a diverse range of companies had been looking to expand into the Internet video-streaming business. Many firms operating in the Internet streaming industry sought exclusive licensing agreements with content providers, whether they were cable television networks or production studios.

Although Netflix retained a significant portion of market share in the industry, an increasing number of new entrants had changed the competitive landscape with unique competitive advantages.

One such firm was Hulu, a subsidiary of Hulu LLC, which was a joint venture between The Walt Disney Company, NBC Universal Television Group, and 21st Century Fox Inc. Conceived and launched in 2006, Hulu offered streaming services to subscribers in the United States and Japan and delivered a wide range of content from its content partners for a monthly subscription fee ranging from $7.99 to $11.99 — the

higher fee removing advertisements. By 2015, Hulu had an estimated 9 million subscribers and had managed to secure exclusive streaming rights to a number of popular television programs.

New entrants to the industry also came in the form of multinational information technology companies that expanded their business interests into the Internet video-streaming sector. An example of such a company was e-commerce giant Amazon, which took advantage of its enormous global customer base, strong brand, and powerful computing infrastructure to launch its Amazon Video service. Launched in 2006, Amazon Video was available in a number of countries, including the United States, the United Kingdom, and Japan, and had an estimated 44 million users, second only to Netflix in market share in the streaming industry. Unlike its competitors, Amazon Video offered users the option to rent or buy movies and television shows without purchasing a subscription. The service was also accessible on a wide range of viewing platforms and streaming devices, from the standard web browser to game consoles such as Xbox and PlayStation.

NEW STRATEGIC INITIATIVES

To overcome competition, and to provide unique content to customers, Hastings decided to pursue exclusive licensing agreements and partnerships to develop original content. This move helped Netflix decrease its reliance on content providers. Netflix also began pursuing an aggressive international expansion strategy, which further helped it achieve its goals.

Developing Exclusive Content

In 2013, the political drama House of Cards, starring Kevin Spacey and Kate Mara, was released on Netflix, making it the first content available exclusively on the streaming service. Netflix had begun the process of securing exclusive rights to content in March of 2011, and the success of House of Cards quickly spurned further exclusive partnership deals with content providers, which laid the foundation for Netflix to develop its own content in-house.

Netflix had exclusive distribution rights to television projects from established Hollywood producers such as Lana and Andy Wachowski (Sense8) and Judd Apatow (Love) and had also secured partnerships with Hollywood studios such as The Walt Disney Company and its associated subsidiaries to gain exclusive streaming rights.20 Netflix had ambitious goals for the future of its exclusive content; Hastings stated that the company wanted its original content to be “as broad as human experience.”

The company’s decision to secure exclusive rights to content was fruitful. As of 2015, the most-watched series on Netflix was Orange Is the New Black — one of its exclusive content dramas. The show had been streaming exclusively on Netflix since 2013 and had generated a loyal following and critical acclaim since its debut.

Netflix also ventured into securing the licensing of feature films, which diversified its exclusive content beyond television shows. In 2015, Netflix purchased exclusive global distribution rights to the film Beasts of No Nation, which was released to its subscribers on October 16, 2015, the same day that it was distributed to movie theatres.23 The film was met with critical acclaim and won numerous awards upon its release.

Despite the critical and commercial success of the film, Netflix’s venture into the film industry was met with backlash by established stalwarts in the industry. The film’s simultaneous release through online streaming was viewed by American movie theatres as a violation of the industry’s 90-day release exclusivity.

That rule restricted films from being made available online within 90 days of being released to conventional movie theatres. Netflix’s actions resulted in a boycott of the film from major movie theatre chains.

Netflix planned to continue securing exclusive licensing deals from content providers in the future but was also looking towards further reducing its dependence on content providers by solely producing its own content. The decision to produce its own shows came amidst increasing resistance from content providers such as 21st Century Fox Inc., who were becoming reluctant to license their content to third-party streaming services. By creating its own television shows, Netflix would increase financial commitment and risk. Nonetheless, as of late 2015, the company had leased studio space in Hollywood to begin filming episodes of television shows. In 2016, the company expected to provide 600 hours of original programming, compared with 450 hours in 2015.

International Expansion

Since 2010, Netflix had adopted an aggressive expansion strategy into the global market to offset slow domestic growth in its U.S. market. It also stated its target to expand into 200 countries and establish itself as a global force by 2016. This desire for international expansion had been fuelled by slow growth in a saturated domestic market and by positive results from past entrances into global markets such as Canada.

Before it adopted this international expansion strategy, Netflix reported subscriber growth rates of around 2.4 million people per year. The subscriber growth rate jumped to an average of 7 million subscribers per year following its entrance into the streaming markets of Canada, Europe, and Latin America.26 Netflix reported a record growth of 2.74 million subscribers in its international segment in the third quarter of 2015 and projected subscriber growth in this business segment to increase substantially in the future.

Netflix tried to establish a successful business model for minimizing the risks associated with entering a new market. The company accounted for the cultural differences among regional audiences by entering the markets with limited-time offers, which minimized the financial involvement and potential risks of rolling out the full service in an untested market. It utilized the data gained from these initial subscribers — mostly the types of programming they streamed — to more effectively create region-specific business models that took into account subscriber behaviour in the given market.

Netflix had also recently implemented elements of its new domestic strategic direction — the exclusive licensing of content and developing its own content for streaming — into its international expansion strategy. For example, in preparation for its launch into the Japanese market in the fall of 2015, Netflix partnered with Japanese talent agency Yoshimoto Kogyo to produce exclusive local programs. The deal between Netflix and Kogyo involved Netflix providing funding for the development of a number of programs by the talent agency in exchange for exclusive streaming rights to the programs for a set amount of time.

In January 2016, Netflix made clear its intentions to further its international growth when it announced that its service would be made available in 130 new countries, which expanded its reach to over 190 countries worldwide. The decision meant that Netflix became available in nearly every country in the world, except those that had sanctions imposed upon them by the U.S. government. Notably absent from the list of 130 countries was China, a significant streaming market.

CHALLENGES

Netflix’s implementation of its expansion strategy was not without issues. The company was subject to both U.S. and host country regulations, and it needed to adapt its content offerings to serve the local customers’ needs. In spite of its high brand recognition in the United States, Netflix faced severe competition from local pay television operators and VOD service providers in many countries. Due to these factors, Netflix was expecting to have to make a substantial investment to implement its ambitious international expansion plan.

Regulatory Restrictions

As an American company, Netflix was still subject to regulatory restrictions imposed by the U.S. government. The impact of these restrictions was apparent in its January 2016 expansion announcement, with countries like Syria absent from its line-up.

More concerning for the future of its expansion strategy, however, were the regulatory restrictions imposed by the governments of the countries that Netflix chose for expansion. For example, Indonesia’s censorship agency claimed that much of Netflix’s content was unsuitable for local audiences. Vietnamese regulators were also cautious on similar grounds, and Malaysia was likely to require that Netflix follow its censorship policy, largely due to religious reasons.

China, in spite of its highly attractive market with its enormous, broadband-capable population, was very difficult to operate in because of regulatory challenges. More specifically, entering the Chinese market had proven challenging for Netflix due to strict regulations imposed on the country’s media and entertainment industries. However, Netflix was still exploring possible ways to launch its services in China.

Local Adaptation

The adaptation of content to suit regional markets was another critical challenge in Netflix’s international expansion. Netflix’s aggressive growth strategy came under criticism from industry analysts. They claimed that Netflix was outpacing its ability to provide area-specific, modified content to international subscribers and to develop market penetration strategies that were specific to the host country. David Sidebottom, an analyst at Futuresource Consultancy, pointed out that “people are also more reluctant to pay for a monthly subscription to a video service in France and Germany.”

In addition, despite its presence in more than 190 countries, Netflix only had service available in 20 languages, which put it at a severe disadvantage when competing with the domestic content providers that were present in each country. For example, analysts noted that in India, where only 5 to 7 per cent of households watched television in English, Netflix offered its service only in English. Netflix was also compromised in its ability to stream licensed content when providing access to international subscribers, resulting in severely limited content availability in comparison to that offered to American subscribers. To mitigate restrictions on content availability and the lack of region-specific programming, which was often preferred by domestic television audiences, Netflix explored partnerships and joint ventures with content providers in these markets. This proved to be an expensive strategy. Estimates for Netflix’s spending on international content creation were around $5 billion for 2016.

Competition in the Global Markets

Netflix faced severe competition from incumbent pay television operators and established subscription VOD service providers in local markets. In some countries, Netflix managed the local competition successfully. For example, in September 2010, Netflix launched in Canada and recorded a higher percentage of penetration than it had recorded in the United States (about 45 per cent). Two major domestic service providers already existed in Canada. Shomi was co-owned by Shaw Communications and Rogers Communications, and CraveTV was owned by BCE Bell Canada. However, both of these services had a much lower market share than Netflix.

Netflix was unable to repeat such success in many other countries. For example, India already had four major service providers (Eros Now, Ditto TV, Spuul, and Hotstar) that had substantial customer bases and content. Eros Now had 30 million registered users and rights to over 3,000 Bollywood movies. Ditto TV, owned by Zee Entertainment Enterprises, launched in February 2012 with over 20 million customers. Netflix also faced the problem of relatively underdeveloped infrastructure. Network quality was generally poor, and 4G wireless technology was only starting to gain momentum.

In some countries, Netflix was also facing competitors from both home and host countries. Netflix entered the Japanese market in September 2015, where Rakuten Showtime, one of the strongest local competitors, had over 100,000 movies, dramas, animations, and sports programs. In addition to the local players, Netflix was competing with Hulu Japan, which offered access to 13,000 movies, TV dramas, and anime shows.

Financial Costs

The investment costs of Netflix’s international expansion were formidable. These included not only costs that the company incurred directly through licensing and development but also costs that the company could not control. The cost of broadband and Internet availability in a given market could have a great impact on the company. In fact, Netflix’s profitability in a given market depended upon its availability of the Internet in a country, as well as the ability of the country’s infrastructure to support widespread streaming services. Only 31 per cent of households in developing countries had access to the Internet.

Direct costs incurred by the company included partnerships with domestic content providers for exclusive access to original programming, as well as marketing, distribution, and technology costs associated with rolling out the service. A significant cost for international expansion had been the fees that Netflix paid for global licensing deals. This was a necessary expense for addressing issues with restricted access to American content in regional licensing deals.

In order to compete with both global and domestic competitors, Netflix paid significant premiums for these global licensing deals, which resulted in very high costs for its international business segment.37 In the third quarter of 2015, outside of the United States, Netflix reported losses of $68 million, more than double the $31 million loss it reported the year before for its international business segment.38 Although Netflix’s international expansion aimed to be profitable in the long term, the high costs of undertaking its ambitious strategy resulted in it operating at a significant loss in the short term.

WHAT’S NEXT?

Netflix had been pursuing aggressive international expansion in Europe, Asia-Pacific, and all around the world, mainly through organic growth initiatives. Hastings believed that the novelty of the strategic plan and the company’s constant efforts to improve the services would pay off in the long run. However, in many countries, the market environment was often very different from the environment in the United States.

Netflix was facing substantial uncertainties and challenges as it moved into the global arena. Audiences had strong preferences for local-language and local-content service offerings. The pricing strategy was comparable to its North America and Europe plans, which made local competitors more affordable, leaving piracy as an attractive option in developing countries. Regulatory risk was another challenge in many countries. Could Netflix be as successful in the global markets as it had been in the United States?

Unlock valuable business insights with the 9B16M070: Netflix International Expansion Case Study. Understand Netflix's strategic growth in global markets, its challenges in adapting to diverse cultural, legal, and competitive landscapes, and the factors driving its success. Get Ireland Assignment Help for students and professionals seeking to analyze international business strategy and gain a deeper understanding of global market expansion.