5N1348: How would You Input the Data for the following Customer into the Maintain Customers: Accounting – Manual and Computerised Assignment, BCFE,

1. How would you input the data for the following customer into the Maintain Customers file pictured below?

2. How would you input the data for the following supplier into the Maintain Suppliers file pictured below?

3. What steps are required to add the following nominal account to the Maintain Chart of Accounts file screen pictured below?

4. What steps are required to set up the following product in the Maintain Products/Services screens shown below and on the next page?

5. How would you record the following outstanding customer transactions as at 30th April 2009 (c/f to May opening balances) in the screens pictured below and on the next page?

6. How would you record the following outstanding supplier transaction as at 30th April 2009 (c/f to May opening balances) in the TAS Books screen pictured on the next page?

7. What steps would you need to take to enter the following Opening Bank Balance on the TAS Books screen pictured below? Current Account €85, 943. The account was fully reconciled on 30th April 2009.

8. On 1st May 2009 Erin Footwear received capital of €140,000, deposited into the current account. How would you enter this transaction in the TAS Books file pictured below?

9. On 2nd May the company purchased shop fittings for €53,000 (plus VAT at 21.0%) and paid using Cheque number 100576. How would you enter this transaction in the TAS Books file pictured below?

10. On 2nd May Erin Footwear received an invoice from National Footwear for stock. How would you enter this invoice on the TAS Books file pictured below?

Are You Searching Answer of this Question? Request Ireland Writers to Write a plagiarism Free Copy for You.

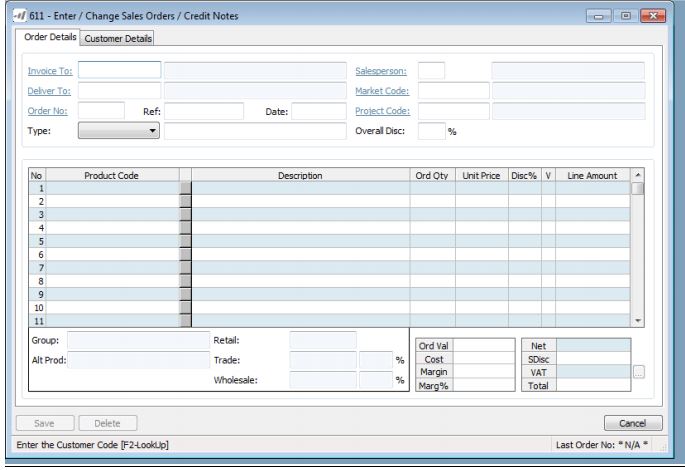

11. What steps would you need to take to create and post the following sales orders (invoices)/credit notes sent to customers for the month of May in the TAS Books files pictured below?

12. What steps should be taken to enter the source documents found on the following pages in the TAS Books screens that follow each document?

13. How would you process a payment for Staff Salaries of €4,300, paid by Direct Debit on 28th May, in the following TAS Books screen?

14. How would you process the following payment in the TAS Books screen below? Rent of €1,800 for May was paid on 30th May by Cheque no. 100596. €1,100 of this amount relates to rent for May and €700 of this amount relates to April.

15. How would you process the following payment in the TAS Books screen below? Insurance of €1,400 was paid on 30th May by Cheque no. 100004. €200 of this amount relates to insurance for May and €1,200 of this amount relates to insurance for the remainder of the year.

16. (a) What is the difference between the two “NL Account Defaults” fields in the TAS Books screen below?

(b) How would you fill in the (i) Date Acq’d and (ii) Acquisition Cost fields in the TAS Books screen extract below?

17. In processing a bad debt write-off in the TAS Books screen below, (i) what should the Posting Type be set to, and (ii) what steps should be followed in completing the Net, VAT and Total fields?

18. Given the following bank statement and TAS Books cash book transactions, how would you go about reconciling this bank account?

19. Outline how you might go about printing the following reports: Trial Balance, Profit & Loss Account, Balance Sheet and Nominal Account Audit Trail

20. Outline your understanding of the terms (i) Restore and (ii) Backup

Do you want to get an amazing boost in your grades? Then contact us to get score worthy assignment writing services for 5N1348: Accounting – Manual and Computerised assignments. We provide unmatched academic assistance to BCFE students at a very cheap price in the different areas of business accounting.