DN710: Without much notice or fanfare, it has completely realigned how we consume most of our content: Economics Assignment, UCD, Ireland

| University | University College Dublin (UCD) |

| Subject | Economics |

The ‘Age of the Streaming Service’ has arrived.

Without much notice or fanfare, it has completely realigned how we consume most of our content. Since its streaming service debuted in 2007, Netflix has been at the forefront of this revolution providing on-demand and commercial-free streaming on any device. But now new competitors are entering the market and the competition is heating up. Once a scrappy upstart of the TV industry, Netflix has become the king of streaming with 280m subscribers, nearly half of the world’s total excluding China.

Netflix, however, faces increased competition in the streaming video market with the entry of Amazon, Disney, and Apple. Netflix added fewer than 4m subscribers globally in the first three months of this year, while Disney Plus lured 9m subscribers in the same quarter. More competition is on the horizon with Comcast (owners of Sky since 2018) and ViacomCBA set to combine forces and launch a new video on demand platform in Europe to be named SkyShowtime combining the Paramount, Universal, and Nickelodeon brands. The joint venture is designed to be more cost-effective than both companies going it alone due to the scale of the operation.

Its rollout is the latest sign of how global media groups are rushing to meet booming demand for streaming video content (including the WarnerMedia and Discovery merger), a trend that has accelerated due to successive lockdowns and the closure of cinemas during the pandemic. For traditional media companies, the opportunity of connecting directly with the global mass of binge-watchers seems too good to pass up.

Netflix, the dominant service, faces a serious challenge from new rivals. As the contest heats up, co-operation may be the only way for many services to survive. Netflix is operating like an incumbent, raising prices and wringing more money from customers. Netflix recently increased the subscription price across its three packages (basic: €7.99, standard €12.99, and Premium: €17.99) for customers across Ireland and Europe, in a move a company spokesperson said was necessary to expand the range of programs and movies on offer.

“To continue adding more TV shows and movies, including many Netflix original titles, we’re modestly raising the price of our two-stream HD plan for new members,” it said. However, some countries did not experience as large a hike in prices including the UK where the equivalent package prices are

basic: €6.99, €10,48, and €16.31). While the incumbent continues to increase prices, Disney and its peers are resembling start-ups, prioritizing growth as they lose billions a year on streaming efforts.

Currently, many commentators are worried that Netflix is building up complete dominance in the market. A lot of people in the industry say that Netflix is the Coca-Cola of the audio-visual industry and may soon have the scale and budget to put all other competitors out of work and charge what they

like.

Are You Searching Answer of this Question? Request Ireland Writers to Write a plagiarism Free Copy for You.

Netflix executives are striving to attain supremacy in home entertainment akin to what Facebook enjoys on social media, Uber in urban transportation, or Amazon in online retailing, all of which rely on an intimidating array of entry barriers in their markets. Netflix has already inflated prices for established talent in the industry, like big-name writers, actors, and directors. For example, industry experts estimate that costs have risen 15 to 20% and this is due to the Netflix effect in a market of relatively fixed labor talent supply.

However, many believe that Netflix has actually stimulated competition in the market and increased the overall size of the market making it profitable for new firms to enter. Producers in the market agree that Netflix has done much to stimulate the market, experimenting with new formats and genres that might once have been deemed to the niche. It has broadened viewer tastes in unexpected ways such as German sci-fi thrillers (Dark).

Whether Netflix can maintain a grip on its current market share remains an issue of much debate. Many efforts at entry into the lucrative video streaming market are likely to flounder. The closure of Yahoo View and NBC’s comedy-focused Seeso show that success in the sector is not guaranteed.

Original content alone is not enough to keep subscribers coming: it has to be of sufficient quality. Customers’ time is finite, with free distractions such as YouTube competing for attention. Customers’ money is limited, too; beyond video streaming, music, video games, and news media are all increasingly subscription-based. Media groups should realize that their slice of the video-on-demand pie may be smaller, and more expensive than they think.

The main pan-European challenger to US streaming groups such as Netflix and Disney Plus is to launch in the UK and Germany, betting its offering of Nordic drama will entice viewers. Nordic Entertainment Group (Net), the Swedish owner of Viaplay, announced on Wednesday that it would be in 16

countries by 2023, adding Austria and Switzerland to the likes of the US, Netherlands, Poland and the Baltics.

It has extensive sporting rights in most of its existing markets, including the English Premier League and Bundesliga football, Formula 1 motor racing, and darts in the Netherlands. But the group will make a lower-cost entry into the UK and Germany, positioning itself as a niche Nordic drama player with the promise of a possible sports offering later on. “We are the non-US streaming challenger and there are not many like us. We are in a quite unique position. We are gradually building things up,” Anders Jensen, the chief executive, told the Financial Times.

US services such as Amazon Prime and Disney Plus dominate streaming in Europe, with national broadcasters lagging well behind, and few cross-border players. Net is expanding rapidly from its The nordic base where it is second behind Netflix in Denmark, Finland, Norway, and Sweden. It currently has 3.3m subscribers but with ambitions to have more than 12m by the end of 2025.

Viaplay is due to launch in the US in December and in the Netherlands at the start of next year. The UK, Germany, Austria, Switzerland, and Canada will follow in early 2023, using the proceeds of SKr4.4bn ($500m) capital raising this year. Jensen said Net was open to entering partnerships with local players such as Britbox, the online streaming service jointly owned by the BBC and ITV. One possible model would be that the local partner would have the first opportunity to show a television series while Viaplay would get the second, and both could market it internationally in different countries, Jensen added.

Net is building clusters of content based on language, with an English one centered on the US and UK, and a German one. It could enter more countries before 2025, Jensen stressed, especially without a sports offering initially, by leveraging its technology platform across markets. “We’re not doing sports

from the beginning for several reasons.

One is timing and availability of rights. Investing in sports in the UK and Germany is pretty expensive,” Jensen added. One possibility could be to concentrate on niche sports. About 800,000 people in the Netherlands watched a darts tournament last weekend and Viaplay has secured the rights for, Formula 1 and Premier League football in the country.

Net believes it will benefit from significant operational leverage as much of its costs are already covered. Revenues should grow by about 20 percent per

year up to 2025 “The question I get is how do we compete with these giants? You have to do it market by market. If you compare us in the Nordics, we are not so far away. We have carved out a niche for ourselves from which we can grow in a sustainable way,” Jensen said. But competing with companies like Netflix will not be easy.

Get Solution of this Assessment. Hire Experts to solve this assignment for you Before Deadline.

Producing original material requires hefty upfront costs — one show alone would most likely cost more than $30 million a year, a sum Netflix reportedly once paid Starz for its entire library of movies. Many of Netflix’s new productions will be developed at the massive new production site in Madrid financed by debt issuance. In addition, Netflix’s latest tactics include testing and tweaking its user interface to make it more appealing to users.

Netflix can track what people watch, at what time of day, whether they watch all the way through or stop after 10 minutes. Netflix uses “personalization” algorithms to put shows in front of its subscribers that are likely to appeal to them. Its ability to analyze vast amounts of data about its customers’ viewing preferences helped it decide what content to buy and how much to pay for it but could also be used for subscriber-specific pricing strategies in the future.

Commissioners across all platforms are becoming more careful and so the ability to predict viewer tastes and big hits are becoming more important.

This has the potential to generate market failure which may be soon subject to regulation. This issue could be exacerbated by the pandemic where the dominance and financial strength of established Big Tech companies could see smaller rivals, struggle, grow weaker, and shut down in the current climate. The future struggle will also involve reaching beyond video to monopolize the attention of audiences in the home and on the go in all types of entertainment. And it will bring “one subscription to rule them all”, as the biggest companies use their ever-expanding armory of digital properties to squeeze out smaller entertainment rivals. Netflix is among the first to lay the groundwork.

It has recently hired experts in podcasting and video games as it looks for more ways to command its audience’s attention. Last month it also launched an online store to sell products linked to its shows, marking another attempt to deepen customer loyalty and extend the broader “experience” it is building around its content. Netflix is looking beyond the video streaming arms race to prepare for the broader battle for attention. The goal of this diversification is straightforward: audience stickiness. With more things to watch, listen to and play, it hopes to give people in the more than 200m homes who pay for its service plenty of reasons to keep tuning in.

Disney, long the leader in assembling a diverse media empire around the “intellectual property” in its entertainment holdings, has also been trying out new, interactive activities that could one day reinforce its streaming services. These include sports betting — a sure way to hook future generations of fans as they stream the latest game from their couches. It will take years for the entertainment world beyond the streaming TV wars to take shape. But it already has a number of implications that will define the future shape of the online entertainment market.

One is that it will favor the big players. Companies that can make serious investments in new markets without feeling any pressure to reap an immediate return will have a big advantage. This will present a serious challenge to smaller companies that specialize in only one corner of online

entertainment. Another message is that, rather than an array of different offers for their variety of digital services, companies like Netflix plan to sell a single, ever-expanding subscription.

The goal of this new empire-building is not to create a diversified revenue stream. Rather, it is to prevent audience churn, maintain pricing power as competition for video streaming intensifies, and give potential new subscribers ever more reasons to sign up.

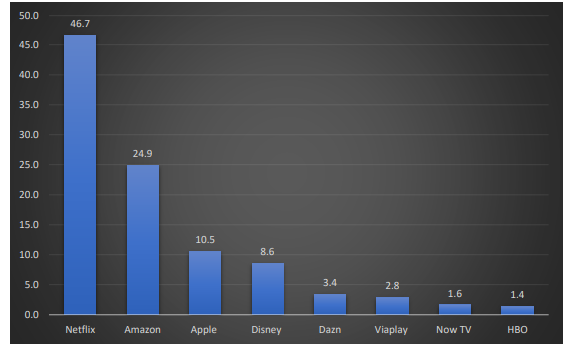

Additional Graphical information

Market shares for key providers in the European Video Streaming market (2021)

Your Task:

Viaplay has employed your consultancy firm, Cultnomics, to produce a report on the European market for Video Streaming and the prospects for Viaplay to penetrate this market and become successful in the short to medium term. They require the report to assess the market from both a traditional economic perspective and a behavioral perspective and, in particular, to evaluate incumbents’ market power, barriers to market entry, market type, and potential internal and external threats to their business using relevant economic models.

They are also interested in an evaluation of a potential pricing strategy for Viaplay to increase revenues or reduce competition in the market. Viaplay informs you that based on their sales department information, the price function for their product currently in their core markets is P = 13.21 -0.367Q where Q is measured in ‘000,000’s. In order to reach the desired goals of the company in terms of market penetration by 2025 (as stated in the case) and subscriber numbers, Viaplay wish to know the price that they should charge for their standard product.

They are also interested in the price and number of subscribers that would maximize their revenue and, separately, their profits, under current economic conditions so that they can target their sales and expansion plans accordingly. Viaplay furnishes you with current marginal cost estimates of €0.50 per additional subscriber.

Viaplay is also concerned by the rapid increase in production costs in the market as a consequence of the Netflix effect and wishes to know the impact on their profit-maximizing price if their marginal cost rises to €1.00 per subscriber. In the new markets that Viaplay intends to enter, the company believes that their niche offering of The nordic drama could command a higher price than current providers in the market.

Consequently, based on forecasted sales data, Viaplay provides you with a new price function for these new markets: P = 35 – 16.67Q (where Q is measured in ‘000,000’s). Viaplay wishes to know the potential elasticity of their product based on this information and pricing options to maximize revenue, and profits, in the new markets based on a marginal cost of €0.50 per additional subscriber. They also request a further evaluation of this potential pricing strategy based on behavioral economic analysis.

You are NOT required to evaluate ALL of the case study market dynamics.

You should instead FOCUS on those features that you consider most important (Remember critical depth is important, and you cannot go into depth by attempting to examine EVERYTHING in the case).

Your firm faces a challenging and changing business environment as outlined in your case and your examination of selected changes must be reflected in the ‘organic’ and changing diagrams/models you apply to examine market developments.

Remember, this assignment is a ‘managerial economics’ exercise where you use economic models to critically evaluate events depicted in the case. It is not merely a business report summarising events.

The case study provides a summary of firm and market conditions.

You must use:

(i) economic terminology,

(ii) economic concepts, and

(iii) economic models and

(iv) mathematical calculation to analyze these dynamics and potential dynamics in a critical manner.

Are You Searching Answer of this Question? Request Ireland Writers to Write a plagiarism Free Copy for You.

Get experts help to finish your Economics Assignment before deadline. Hire an writer at Irelandassignments.ie who provide you 100% error-free & Plagiarism free assignment at affordable prices.